Designing Effective Leadership 3758300585

Effective leadership is a complex construct that demands a blend of vision, ethics, and communication. In contemporary organizations, leaders must adapt to shifting landscapes while nurturing team dynamics. This requires not only setting clear goals but also recognizing the unique strengths of each member. As the landscape of leadership evolves, it prompts a critical examination of how these elements intertwine. What strategies will emerge as essential for fostering a resilient and innovative organizational culture?

Understanding Leadership in the Modern Context

As organizations navigate the complexities of a rapidly changing global landscape, understanding leadership in the modern context becomes imperative.

Transformational leadership emerges as a pivotal approach, fostering innovation and adaptability. Coupled with situational awareness, leaders can effectively respond to dynamic challenges, empowering teams to thrive.

This synergy not only enhances organizational resilience but also cultivates a culture of freedom, encouraging individuals to express their potential fully.

Key Principles of Effective Leadership

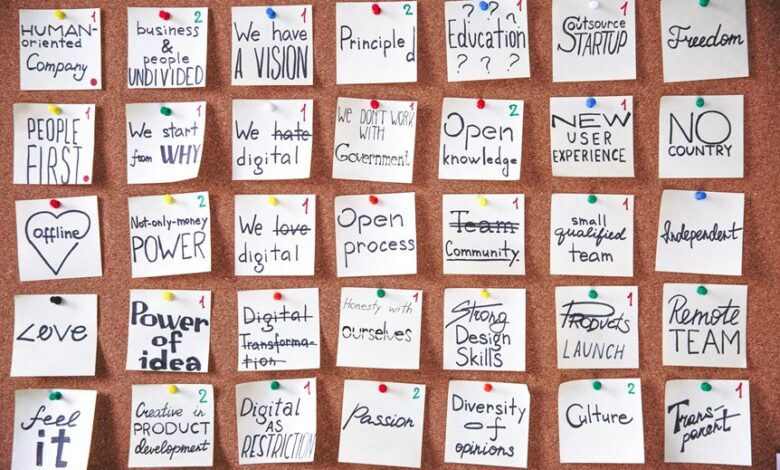

What defines effective leadership in today’s complex organizational landscape? Key principles include visionary leadership that inspires innovation and ethical decision making, fostering trust and accountability. Leaders must navigate challenges with clarity and purpose, guiding teams toward shared goals. Below is a summary of these principles:

| Principle | Description | Impact |

|---|---|---|

| Visionary Leadership | Inspires and motivates teams | Enhances creativity and growth |

| Ethical Decision Making | Ensures integrity and trust | Builds strong organizational culture |

| Communication | Fosters transparency | Encourages collaboration |

| Adaptability | Embraces change | Promotes resilience |

| Empowerment | Delegates authority | Increases team engagement |

Strategies for Inspiring and Motivating Teams

Inspiring and motivating teams requires a multifaceted approach grounded in strategic principles.

Establishing clear goals provides direction, while fostering open communication cultivates trust and collaboration among team members.

Additionally, recognizing individual contributions not only boosts morale but also reinforces a culture of appreciation, ultimately driving collective success.

Establish Clear Goals

Establishing clear goals serves as a fundamental strategy for inspiring and motivating teams, as it provides a roadmap for success and a shared vision for collective effort.

Effective goal setting aligns individual aspirations with organizational objectives, enhancing engagement.

Foster Open Communication

Although many factors contribute to effective leadership, fostering open communication stands out as a crucial element in motivating and inspiring teams.

By promoting active listening and establishing a robust feedback culture, leaders empower team members to express their ideas freely.

This transparency not only enhances collaboration but also cultivates trust, ultimately driving engagement and performance while respecting individual autonomy within the organizational framework.

Recognize Individual Contributions

Recognizing individual contributions is a fundamental strategy that significantly enhances team motivation and cohesion.

Effective implementation can include:

- Establishing employee recognition initiatives.

- Developing appreciation programs that celebrate personal achievements.

- Creating feedback loops that foster talent acknowledgment.

- Utilizing contribution mapping to visualize and value each member’s impact.

These strategies cultivate an environment where freedom and creativity flourish, ultimately driving team success.

Fostering Collaboration and Innovation

How can organizations cultivate a culture that encourages both collaboration and innovation?

By fostering positive team dynamics and promoting an environment for creative problem solving, organizations can unlock diverse perspectives.

Encouraging open communication and risk-taking empowers individuals, allowing them to contribute meaningfully.

Such a culture not only enhances collaboration but also drives innovation, enabling organizations to adapt and thrive in an ever-changing landscape.

Navigating Organizational Challenges

As organizations strive to maintain competitiveness, they must adeptly navigate a myriad of challenges that can impede progress and hinder effectiveness.

Key strategies include:

- Cultivating organizational resilience.

- Enhancing leadership adaptability.

- Fostering open communication.

- Embracing continuous learning.

These elements are crucial in empowering leaders to address obstacles, ensuring a proactive approach that promotes freedom and innovation within the organizational framework.

Developing Your Personal Leadership Style

In the quest for effective leadership, developing a personal leadership style is paramount.

This process involves a thorough assessment of one’s strengths, embracing authenticity to foster genuine connections, and the ability to adapt to varying situations.

Assessing Your Strengths

What factors contribute to an individual’s effectiveness as a leader? A comprehensive strength assessment and skills inventory reveal critical insights.

Key elements include:

- Self-awareness of personal strengths

- Ability to adapt leadership style

- Communication proficiency

- Emotional intelligence

Evaluating these components fosters an understanding of personal leadership style, empowering individuals to harness their unique abilities and lead with authenticity.

Embracing Authenticity

While many leaders may attempt to emulate the styles of others, true effectiveness stems from embracing one’s authentic self.

Authentic leadership arises from a deep understanding of personal values, fostering genuine connections and trust.

Adapting to Situations

How can leaders effectively navigate the complexities of diverse situations while remaining true to their authentic selves?

They must cultivate situational awareness and employ adaptive strategies that resonate with their core values.

Key approaches include:

- Assessing environmental cues

- Tailoring communication styles

- Embracing flexibility in decision-making

- Fostering collaborative engagement

This balance empowers leaders to thrive amidst challenges while maintaining integrity.

Conclusion

In conclusion, effective leadership is crucial for organizational success in today’s complex landscape. A striking statistic reveals that organizations with strong leadership see a 20% increase in employee engagement, underscoring the direct link between effective leadership practices and workforce morale. By embracing visionary thinking, ethical decision-making, and fostering collaboration, leaders not only enhance team dynamics but also drive innovation and resilience. Ultimately, cultivating a supportive leadership culture is essential for aligning individual aspirations with broader organizational goals.