Upgrade Your Business 9165475906 Today Quickly

In the competitive landscape of modern business, identifying areas for improvement is crucial. Companies must leverage innovative tools and tailored strategies to enhance operational effectiveness. Quick action can significantly influence growth and adaptability, allowing organizations to maintain a competitive edge. As the market evolves, the need for strategic upgrades becomes ever more pressing. What steps can be taken to foster a culture of innovation that drives sustainable success? The answer may lie in a simple call.

Identifying Areas for Improvement

How can businesses pinpoint their weaknesses to foster growth? A systematic process evaluation is crucial.

By analyzing performance metrics, organizations can identify inefficiencies and areas for improvement. This strategic approach not only enhances operational effectiveness but also empowers teams, fostering a culture of innovation.

Embracing this clarity leads to informed decisions, enabling businesses to adapt and thrive in a competitive landscape.

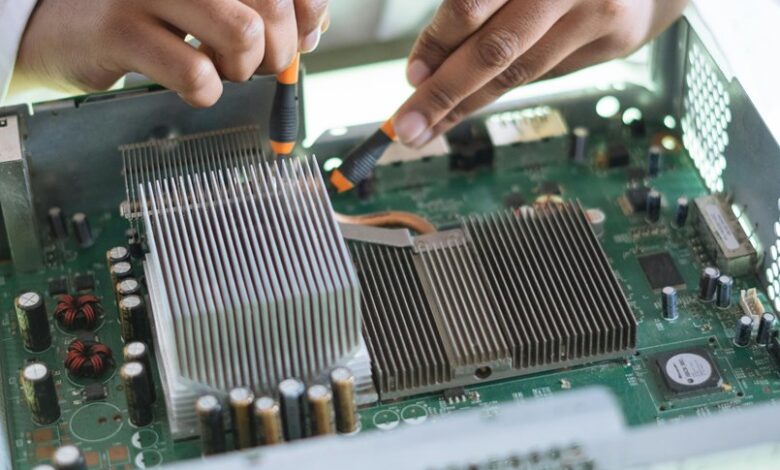

Innovative Tools and Technologies

Identifying weaknesses is only the first step; leveraging innovative tools and technologies can significantly drive business growth.

By adopting cutting-edge solutions, companies can facilitate digital transformation, streamline operations, and enhance customer engagement.

These advancements not only improve efficiency but also empower businesses to adapt swiftly to market changes, ultimately fostering the freedom to innovate and succeed in an ever-evolving landscape.

Tailored Strategies for Growth

A targeted approach to growth is essential for businesses aiming to thrive in competitive markets.

Customized solutions enable organizations to address unique challenges effectively, while strategic planning lays the foundation for sustainable development.

The Importance of Quick Action

Timeliness is a crucial element in the realm of business strategy, where the ability to act swiftly can dictate success or failure.

Quick, timely decisions often yield a competitive advantage, enabling businesses to capitalize on fleeting opportunities.

In an ever-changing market, the capacity to respond effectively empowers organizations, fostering innovation and growth, ultimately leading to sustainable freedom and success in their endeavors.

Conclusion

In the competitive landscape of today’s market, taking decisive action is crucial; as the saying goes, “time waits for no one.” By identifying areas for improvement and employing innovative tools, businesses can tailor strategies that drive growth and sustain success. Embracing a proactive approach not only empowers teams but also cultivates a culture of innovation. Organizations must act swiftly to seize opportunities and enhance operational effectiveness, ensuring they remain ahead of the curve in an ever-evolving environment.